I really like the Basic Materials Sector as a whole, and this post is about the Agricultural Inputs industry in that sector—specifically producers of seeds, fertilizer, and crop protection products.

The space accounts for about $150B market capitalization, with revenues of close to $14B in the last year. The industry has grown its revenue almost 6% in the last 5 years.

Of the 42 Basic Materials companies in the Russell 1000, only 5 are Agricultural input companies: Corteva Inc, CF Industries, The Mosaic Company, FMC Corp, and Scott’s Miracle Gro Co.

CTVA, CF, MOS, FMC, SMG

For this post, I’m adding four others to the mix, that aren’t included in the Russell 1000:

the largest fertilizer producer in the group, Nutrien;

Israeli phosphate and potash producer, ICL;

Norwegian crop nutrition & industrial nitrogen producer, Yara International.

and the German healthcare and agriculture conglomerate that is Bayer.

NTR, ICL, YRAIF, BAYRY

Corteva Inc. [Seeds & Crop Protection]

Bayer [Seeds & Crop Protection]

Nutrien [Largest Nitrogen, Potash, Phosphate Producer, by capacity]

CF Industries Holdings Inc. [Largest Ammonia Producer]

The Mosaic Company [Phosphate & Potash Producer]

Yara International [Ammonia & Nitrogen Producer]

FMC Corp [Crop Protection]

ICL [Phosphate & Potash Producer]

The Scotts Miracle Gro Company [Gardening & Lawncare, Cannabis]

So, those are the nine largest companies in this space that you’d want to debt-hijack and saddle with DEI & ESG regulation, in your organization’s attempt to control the global food supply.

CTVA, BAYRY, NTR, CF, MOS, YRAIF, FMC, ICL, SMG

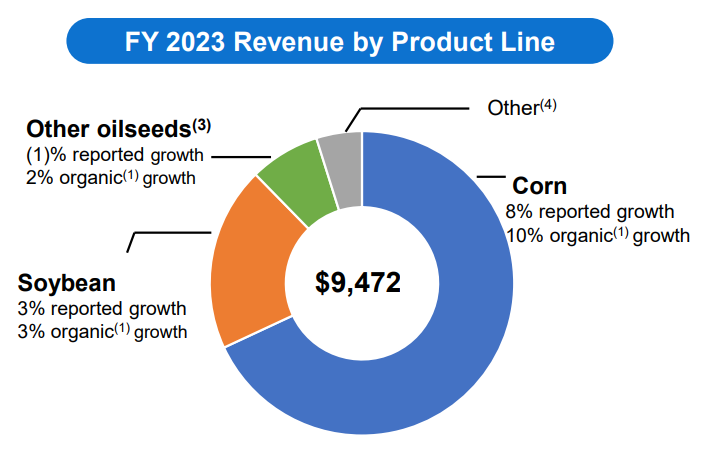

Headquartered in Delaware, Corteva is an agriculture pure play formed in 2019 when it was spun off from DowDuPont. The $39 billion dollar company is a leader in the development of new seed and crop chemicals products. Seeds generate about 55% of revenues with the remaining 45% coming from crop protection chemicals. Corteva operates globally, and half of revenue comes from North America. In the full year of 2022, seed net sales increased by 5%, and organic sales rose by 7%. 45% of revenues are derived from crop protection products while seeds make up 55%, and corn seeds make up nearly 75% of seed sales

Corteva Launches Corteva Catalyst

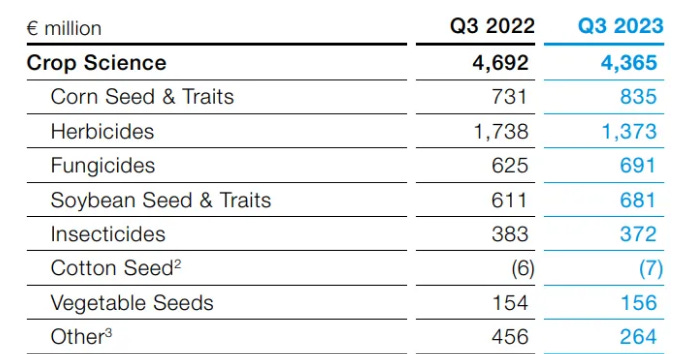

Bayer is a German healthcare and agriculture conglomerate. You might have heard of them. Healthcare provides close to half of the company's sales and includes pharmaceutical drugs as well as vitamins and other consumer healthcare products. Bayer’s Crop Science business -about half of total sales - includes the production of seeds, pesticides, herbicides, and fungicides, which was expanded through the acquisition of Monsanto. 40% of Crop Science sales came from seeds in Q3 2023. Corn seeds made up half of that.

Bayer’s New Way Of Doing Business: The Future is Now For Crop Science | AgWeb

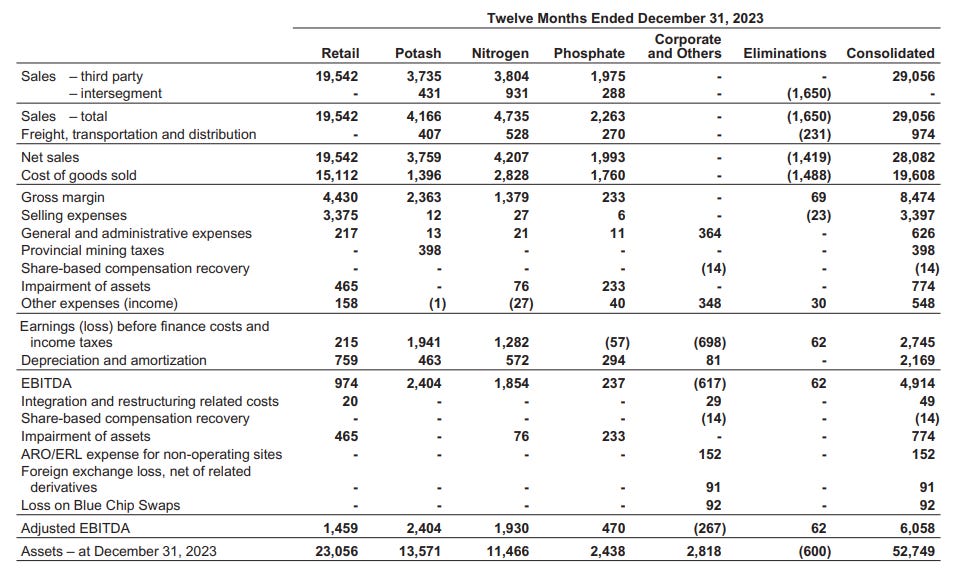

Created in 2018 as a result of the merger between PotashCorp and Agrium, Nutrien’s main focus is potash, although they produce three main crop nutrients—potash, nitrogen, and phosphate. They are the world’s largest soft rock miner and potash producer in the world, with over 20% market share and 20 million tons of potash capacity at six potash mines in Saskatchewan.

Nutrien is also the third-largest nitrogen producer in the world, and the second largest North American phosphate producer. They’re also the largest agricultural retailer in the United States; selling fertilizers, crop chemicals, seeds, and services directly to farm customers through its brick-and-mortar stores and online platforms.

The New CF Industries™ is the world’s largest ammonia producer and distributor of ammonia, urea, ammonium nitrate, and nitrogen. It operates nitrogen manufacturing plants primarily in North America, but CF also holds a joint venture interest in a nitrogen production facility in Trinidad and Tobago. It used to manufacture fertilizer in the UK as well.

CF makes nitrogen primarily using low-cost U.S. natural gas as its feedstock, making CF one of the lowest-cost nitrogen producers globally.

They’re also investing in carbon-free blue and green ammonia, which was nearing mechanical completion in late 2023.

CF is also working on a carbon dioxide dehydration and compression unit at their Donaldsonville location, which will enable them to permanently sequester 2 million tons of CO2 per year. The project is on track for startup in early 2025.

In June 2022, CF Industries permanently shut their fertilizer factory in the UK due to continuing high gas prices and environmental taxes.

CF breaks down their net sales into 4 segments [FY 2023]:

Ammonium Nitrate solutions (34%),

Granular Urea (30%),

Ammonia (28%),

and Ammonium Nitrate (8%).

Formed in 2004 by the combination of IMC Global and Cargill's fertilizer business, Mosaic is one of the largest phosphate and potash producers in the world. The company's assets include phosphate rock mines in Florida, Brazil, and Peru and potash mines in Saskatchewan, New Mexico, and Brazil. Mosaic also runs a large fertilizer distribution operation in Brazil through its Mosiac Fertilizantes business, which the company acquired from Vale in 2018.

Mosaic’s North America Business includes seven potash and phosphate mining facilities primarily located in Saskatchewan and Florida, along with five phosphate concentrates sites in Louisiana and Florida. Their products account for 73% and 40% of North America's phosphate and potash annual production, respectively.

Mosaic's South America Business includes potash and phosphates facilities across Brazil, Paraguay, and Peru—26 locations in total, including all production and blending facilities, as well as offices.

They break their sales volumes down into three segments: Potash (39.5%), Phosphate (44.5%), and Fertilizantes (16%) [FY 2023]

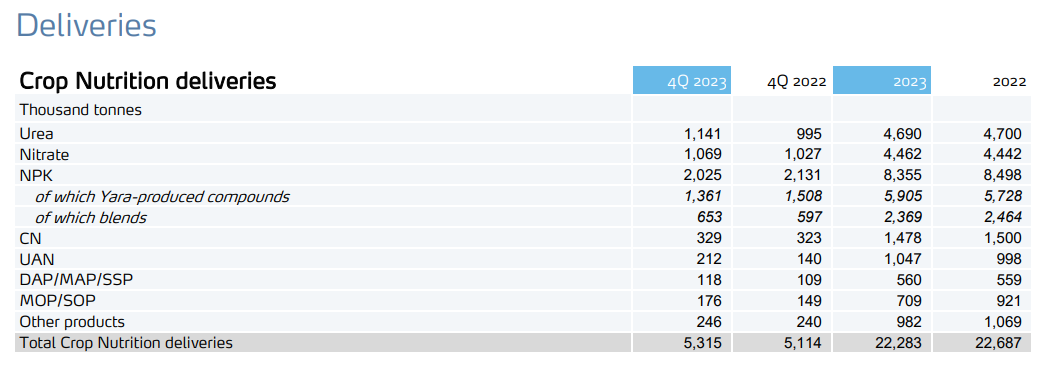

Yara International is a crop nutrition company. The company converts natural gas into nitrogen products. It is engaged in the production of ammonia, mineral fertilizers, and industrial products. The firm also develops and markets environmental solutions and essential products for industrial applications. It markets and distributes a complete range of crop nutrition products and programs globally. The firm operates in five segments: Europe, Americas, Africa & Asia, Global Plants & Operational Excellence, and Industrial Solutions.

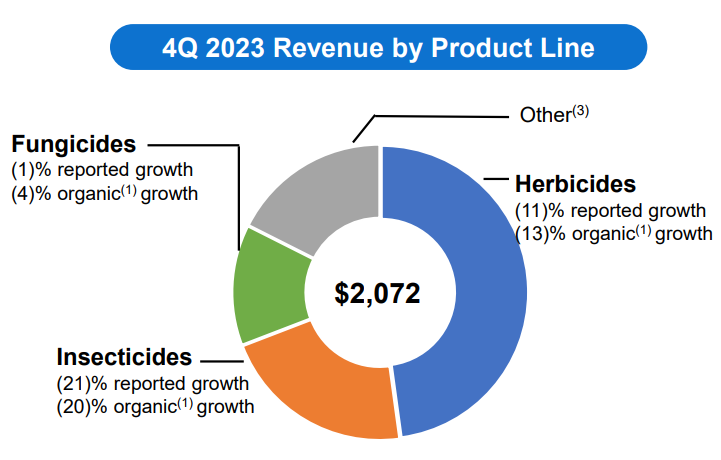

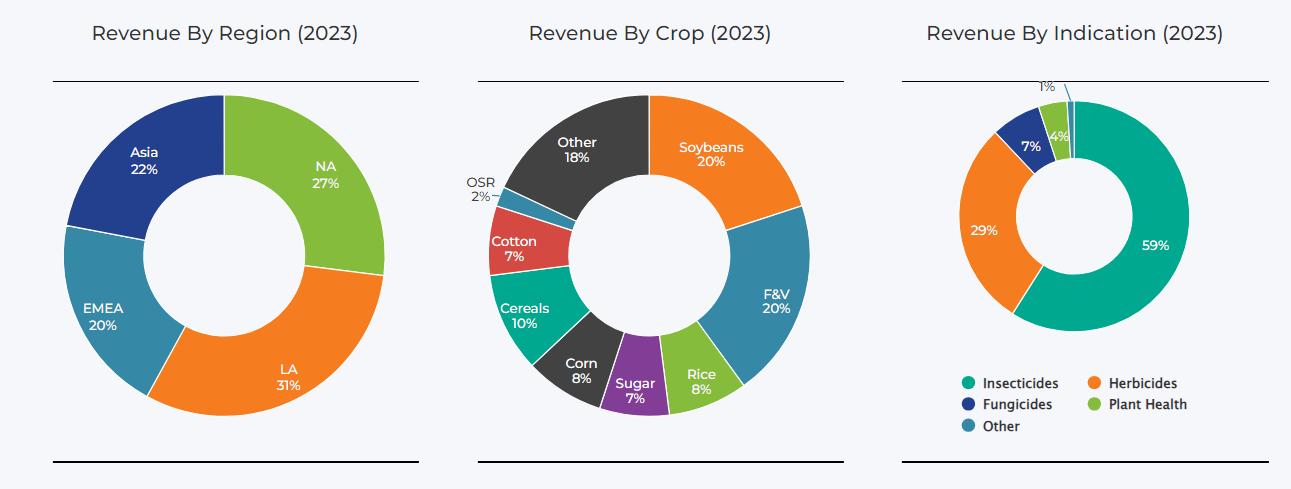

Headquartered in PA, USA, FMC is a global crop protection company that focuses on the development of new products, including biologicals, through its R&D pipeline. Originating as an insecticide company in 1883, the company has an interesting history; including being awarded a contract to design and build amphibious tracked landing vehicles for the United States Department of War in 1941. Sources of revenue are fairly balanced across products and global regions and 40% of revenues are derived from soybean and fruits and vegetables crop protection. Insecticides (59%) and herbicides (29%) account for almost 90% of revenue.

FMC Precision Agriculture solutions include Arc™ farm intelligence, 3RIVE 3D® application technology and PrecisionPac® solutions.

ICL Group is comprised of four segments: phosphate solutions, potash, industrial products, and innovative agriculture solutions (IAS). The company mines and manufactures potash and phosphates to be used as ingredients in fertilizers and serve as a component in the pharmaceutical and food additives industries. It is also engaged in industrial additives and materials, including flame retardants, phosphate salts, specialty phosphate blends, purified phosphoric acid, clear brine fluids, and electronic-grade specialty phosphoric acids. Its geographical segments are Europe, Asia, North & South America, and the Rest of the world.

ICL is a leading manufacturer of magnesium oxide and potassium chloride which are preferred ingredients in many animal and pet feed mixtures. Dead Sea Magnesium (DSM improves the digestibility of animal feed mixtures and results in improved reproduction in cows and sows.

ICL could also be seen as a water play, as its phosphoric acid and bromide are used in water and waste treatments to neutralize contaminants and control bacterial growth. Their phosphates are also used for pH control on industrial boilers to prevent corrosion.

Their specialty phosphate-based materials, which in combination with calcium, sodium, or fluorine are actively absorbed into teeth and used in the formulation of oral and dental products. ICL also formulates ingredients for the cosmetic industriy.

Scotts Miracle-Gro is the largest provider of gardening and lawncare products in the United States. The majority of the company's sales are to large retailers that include Home Depot, Lowe's, and Walmart. Scotts Miracle-Gro can sell its products at a higher price point than its competition because of a well-recognized portfolio of brands that include Miracle-Gro, Roundup, Ortho, Tomcat, and Scotts. Scotts is also the leading supplier of cannabis-growing equipment in North America through its Hawthorne business.

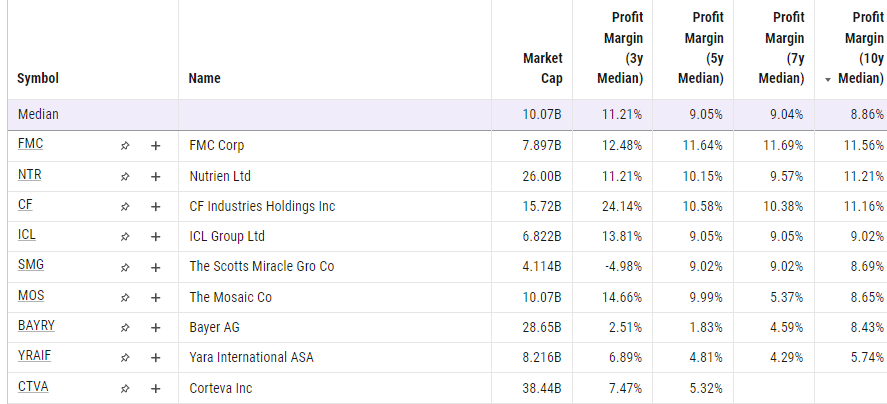

The median 10-Year Profit Margin for this group is 8.86%

FMC Corp wins out on Profit Margin; however, CF Industries -twice the size of FMC- has had a higher profit margin in the last 3 years (24.14%).

CF Industries wins out on Free Cash Flow-to-Debt. i.e. it has the best cash flow position out of the bunch.

ICL Group is investing the most of its retained earnings back into its business for long term operational growth. For every dollar it makes in revenue, it’s spending about ten cents on capital expenditures meant to expand revenue-generating capabilities. This makes sense, given ICL’s smaller market capitalization.

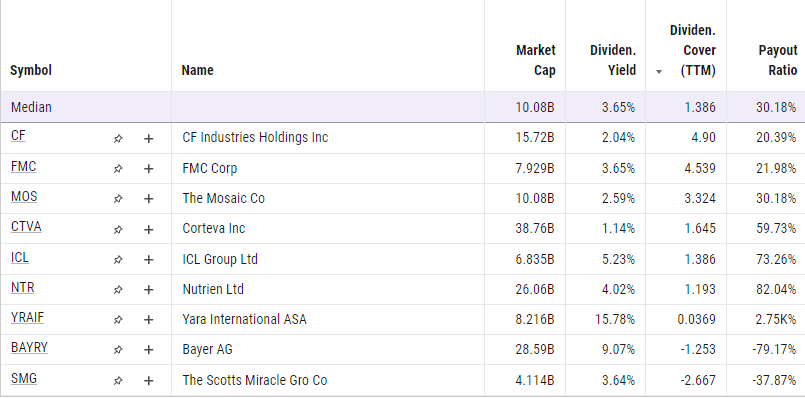

At 15.78%, Yara International has the highest dividend out of the bunch. But its dividend cover of 0.0369 and payout ratio of 2.75k% spell out trouble.

Often times, people look at the dividend yield without considering its health. That’s a mistake. We see here that CF, FMC, and MOS have the highest dividend covers out of the bunch. Coming in second, FMC can pay its 3.65% dividend a little over 4.539 times, if needed. CF Industries is twice the size of FMC, which - generally speaking - means less risk, so you’ll typically see a lower dividend yield.

I personally own six of these names.

Books ranked, as of today 3/25/2024:

CF

YARIY

MOS

ICL

FMC

NTR

SMG

BAYRY

CTVA

Related Links:

AgWeb - Agriculture news, commodity markets insights and weather

Toyota Takes Aim at EVs With Ammonia Engine (enginelabs.com)

Agricultural Inputs Market Size, Share, Trends, Growth & Forecast (verifiedmarketresearch.com)

This is why food security matters now more than ever | World Economic Forum (weforum.org)